✔️ Eliminate Noise, Maximize Value: Our AI filters irrelevant content, curating precise, high-impact news—so you focus on insights, not distractions.

✔️ Precision Alerts, Zero Fluff: Receive notifications only for topics or entities you define. No excess noise—just actionable updates.

✔️ AI-Driven Competitive Edge: Leverage an advanced research assistant to track trends, market & tech shifts, major events and monitor key players in real-time.

✔️ Morning Intelligence, Simplified: Start each day with a custom briefing tailored to your preferences. Stay informed, prepared, and ahead.

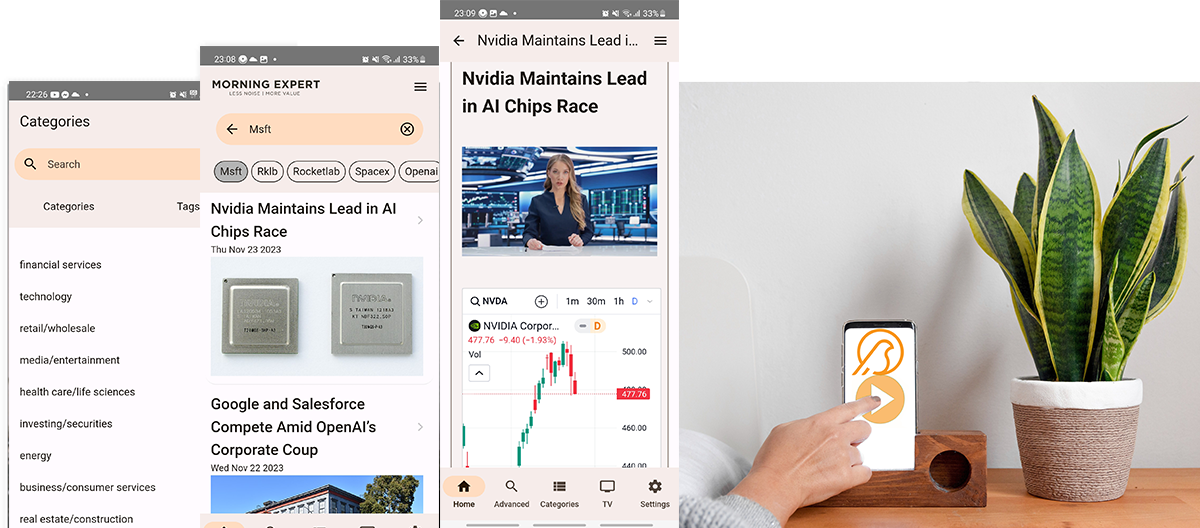

✔️ Your Bespoke News Ecosystem: A fully customizable news feed spanning business, finance, and technology

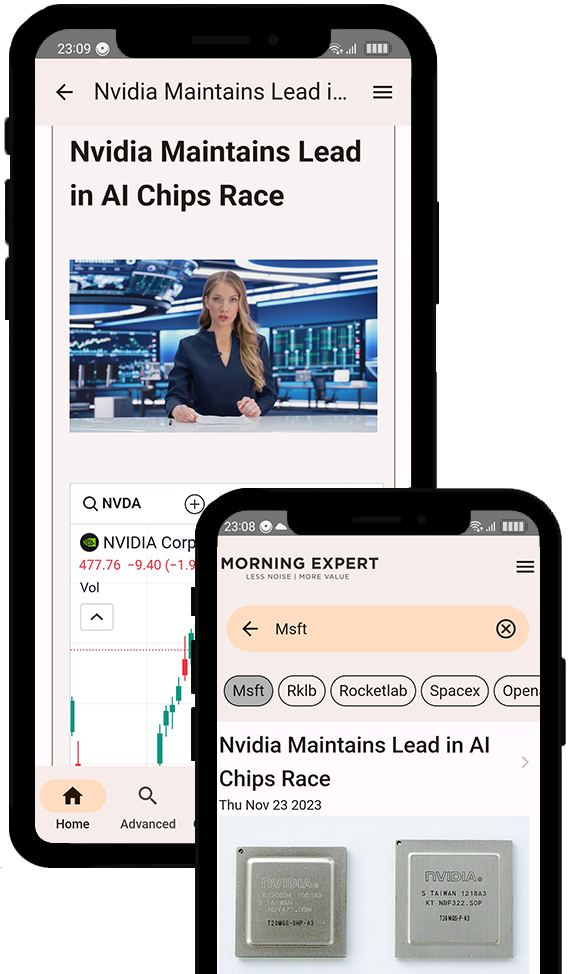

✔️ AI chat with live News and Market Data: Chat with the data that matters to you

Our mission is to reduce the noise that you get on daily basis, but still make sure that you get relevant information and to be ahead of the competition.

It's not just news! It is a personalized journey into the day ahead.

Simple. Intelligent. Essential.

Set alarms that deliver updates on your followed companies, industries, and people as you start your day.

Our AI companion will read you the content you are interested in with key visual information such as charts, photos and images related to the topics.

Only the news you care about, ranked and filtered for relevance—breaking updates mixed with meaningful insights.

Dive deep with filters like keywords, factuality, noise levels, financial impact, and more..

Get updates via email, browser, app, or YouTube. Upcoming: WhatsApp, Instagram, and more.

We have top of the class email digest.

We are dedicated to our mission and welcome you to this journey so we can do it together.

This is no BS text. We will really listen to your feedback and take action.

You will have direct contact with the App creators.

Registering in the app is super easy, you can do it through the app, from the Sign-up button.

Set your interests.

They can be: Tags, Categories, Markets, Companies, People, etc...

Set the level of Noise, Factuality, Extremely.

You can set *Morning* Alarm from the setting, based on your criteria. For instance, every morning for you to be woken by information about "AAPL, MSFT and anything related to the AI business".

Our AI companion will make sure to wake you up with the brief for the last 24 hours.

You can further set communication channels, such as email subscription, watch live TV and other features.

Financial Markets & Tech Enthusiasts who are tired of news clutter