Food Prices and Supply Chains at Risk

- UK and Ireland retailers warn of devastating consequences of a no-deal Brexit

- Increased tariffs and regulatory checks could lead to higher food prices

- Tariffs could increase up to 45% on some everyday food items

- Non-tariff barriers such as checks and delays also cause concerns

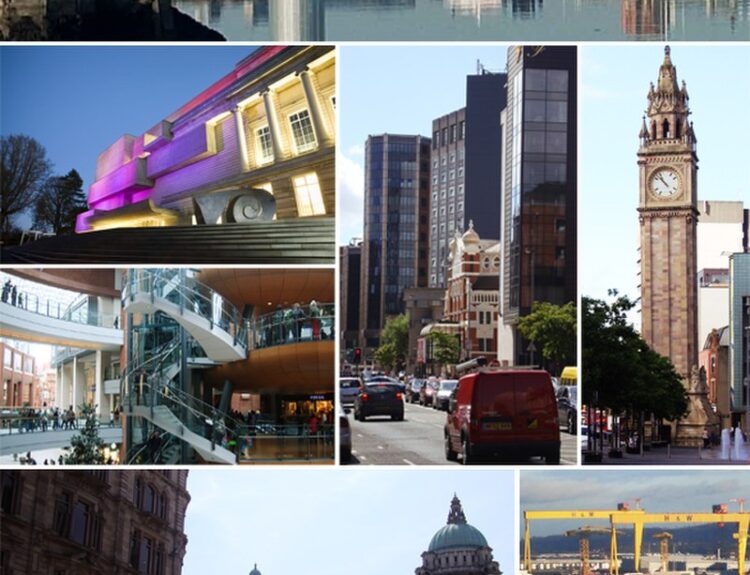

- No-deal Brexit would make Northern Ireland less competitive and more expensive to live in

With just 36 days until the UK leaves the EU, leading retail bodies in Ireland, Northern Ireland, and the United Kingdom have issued a joint statement warning about the devastating consequences of a no-deal Brexit. The British Retail Consortium (BRC), Northern Ireland Retail Consortium (NIRC), and Retail Ireland highlighted increased tariffs and new regulatory checks would lead to higher food prices. These tariffs could see up to 45% increases on some everyday food items if the UK and EU revert to World Trade Organisation Most Favoured Nation Tariffs. They also expressed concerns about non-tariff barriers like checks and delays. Aodhán Connolly, Director of NIRC, said a no-deal Brexit would hit Northern Ireland families hardest as they have less discretionary income than British households. William Bain, head of EU and international at the BRC, added that a ‘no deal’ outcome would affect food supply chains and lead to higher prices in Great Britain, Maidenhead, Belfast, and Dublin. The retailers emphasized the importance of avoiding such consequences.

Factuality Level: 10

Factuality Justification: The article provides accurate information from reputable sources and presents a clear argument based on facts and data. The concerns raised by the retail trade bodies are supported by specific examples and potential consequences of a no-deal Brexit. It also includes quotes from relevant figures in the industry to provide additional context and perspective.

Noise Level: 3

Noise Justification: The article provides relevant information about the potential consequences of a no-deal Brexit on the retail industry in Ireland, Northern Ireland, and the United Kingdom. The concerns raised by the trade bodies are specific to the topic and supported by examples such as increased tariffs and costs. While it does not delve into long-term trends or offer solutions, it is informative and stays on topic without diving into unrelated territories.

Financial Relevance: Yes

Financial Markets Impacted: The no-deal Brexit scenario could impact the retail industry in Ireland, Northern Ireland, and the United Kingdom, potentially affecting food prices and supply chains for consumers.

Financial Rating Justification: This article discusses the potential economic consequences of a no-deal Brexit on the retail industry and consumer prices in the UK, Ireland, and Northern Ireland, which are relevant to financial markets as they involve trade and business operations.

Presence Of Extreme Event: No

Nature Of Extreme Event: No

Impact Rating Of The Extreme Event: No

Extreme Rating Justification: There is no extreme event mentioned in the text.

www.retailsector.co.uk

www.retailsector.co.uk